Once you repay a loan, you pay out back again the principal or capital (the first sum borrowed with the bank) and also desire (the charges used via the bank for their income, which improve over time). Interest expanding over

You aren’t just paying again a monthly principal; There exists interest to take into consideration, and month-to-month expenses and also other expenditures That may come up.

We do not present economic suggestions, advisory or brokerage services, nor will we advocate or advise persons or to obtain or market specific stocks or securities. Functionality information could have modified Because the time of publication. Earlier performance will not be indicative of future results.

You can even look at the loan calculator in reverse. Learn how A lot it is possible to borrow according to a every month payment which you can afford for the desire prices that you could be made available.

Examining account guideBest checking accountsBest absolutely free checking accountsBest on the internet Test accountsChecking account solutions

Naturally, fascination even now accrues over this time, so any ‘downtime’ in which you’re not having to pay off your loan means that there will be far more to repay Eventually. Nevertheless, and Here is the essential part, the slate is wiped clean in the long run; there

This subsequent part focuses on the example of university student loans, but the information and tips can implement to every type of loans. So Continue reading to find out how to shorten and shrink your loan.

The calculator requires these variables into consideration when deciding the real yearly share price, or APR with the loan. Using this APR for loan comparisons is most probably to generally be far more precise.

This demanding cease-loss investing strategy usually means the hedge fund goes through a lots of employees, sporting a significant turnover rate of about fifteen%-twenty% of its workers on a yearly basis.

shares The tactic a $69 billion hedge fund takes advantage of to make certain it hardly ever loses dollars during the inventory sector

These may be served with financial debt consolidation loans, but these have supplemental expenses that you simply’ll have to think about, at the same time — and it may harm your economic condition or credit score in case you overlook payments.

Tower Loan presents a range of installment loans in Tuscaloosa according to the amount that most closely fits your preferences. This lets you program your payment monthly and prevents skipping payments as a consequence of revolving debit's monthly fascination adjustments.

Loan refinancing requires using out a new loan, typically with extra favorable terms, to switch an existing loan. Borrowers can refinance click here their loans to shorter terms to repay the loans more rapidly and conserve on fascination.

Tower Loan has long been assisting our buyers with loans in Tuscaloosa, AL, along with the bordering states because 1936. There isn't any have to have to worry about turning out to be trapped in revolving personal debt due to the fact all of our loans have equal installment payments.

Emilio Estevez Then & Now!

Emilio Estevez Then & Now! Alana "Honey Boo Boo" Thompson Then & Now!

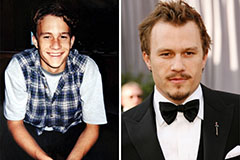

Alana "Honey Boo Boo" Thompson Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Heather Locklear Then & Now!

Heather Locklear Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!